Using QuickBooks can significantly simplify bookkeeping tasks for small businesses and individuals. QuickBooks is designed to automate many aspects of financial record-keeping, making it more efficient and reducing the likelihood of errors. However, whether you need a bookkeeper when using QuickBooks depends on various factors:

Factors to Consider:

- Business Complexity:

- If your business has simple financial transactions and a low volume of transactions, you might be able to manage your bookkeeping using QuickBooks on your own. However, as the complexity of transactions increases, you may benefit from professional assistance.

- Time and Expertise:

- Do you have the time and expertise to handle bookkeeping tasks effectively? QuickBooks can streamline processes, but it still requires some understanding of accounting principles and the software itself. If you lack the time or expertise, hiring a bookkeeper could be beneficial.

- Financial Compliance:

- If your business is subject to specific regulations or tax requirements, a bookkeeper can help ensure that your financial records are compliant. They can also assist with preparing financial reports for tax purposes.

- Scale of Operations:

- As your business grows, the volume and complexity of financial transactions may increase. A bookkeeper can help manage the growing demands of bookkeeping, freeing up your time to focus on running and growing your business.

- Accuracy and Precision:

- Bookkeepers are trained to be accurate and detail-oriented. If you want to ensure that your financial records are meticulously maintained, a bookkeeper can provide that level of precision.

- Strategic Financial Guidance:

- Bookkeepers not only record transactions but can also provide insights into your financial health. They can help you analyze financial statements and make strategic decisions for your business.

How QuickBooks Can Help:

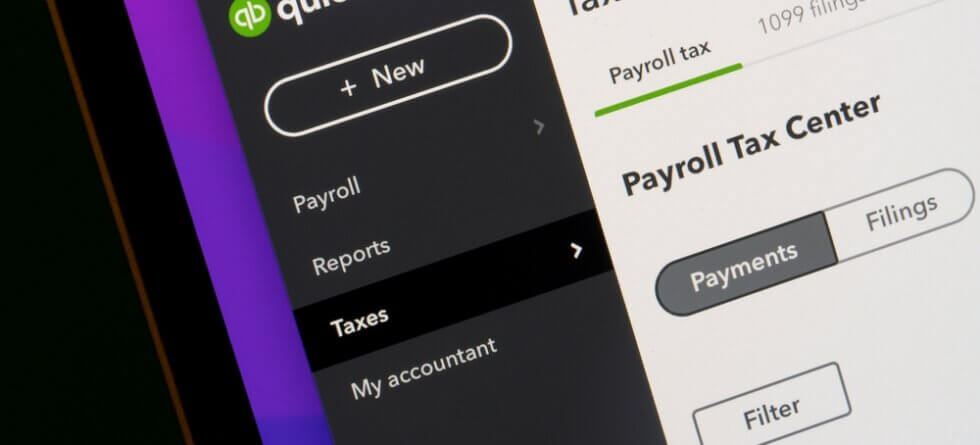

- Automation: QuickBooks automates various bookkeeping tasks, such as transaction categorization, reconciliation, and financial report generation.

- Integration: QuickBooks can integrate with bank accounts, credit cards, and other financial institutions, reducing the manual entry of transactions.

- Accuracy: The software helps minimize errors and ensures that your financial records are accurate.

- Reporting: QuickBooks provides a range of financial reports, allowing you to assess your business’s financial performance.

When You Might Still Need a Bookkeeper:

- Complex Transactions: If your business involves complex transactions, such as inventory management, multiple revenue streams, or international transactions, a bookkeeper can help manage these intricacies.

- Tax Compliance: A bookkeeper can ensure that your financial records are organized and compliant with tax regulations, making tax preparation smoother.

- Financial Analysis: If you require in-depth financial analysis and strategic planning, a bookkeeper or accountant with expertise in your industry can provide valuable insights.

While QuickBooks can be a powerful tool for simplifying bookkeeping, the decision to hire a bookkeeper depends on the unique needs and complexity of your business. For many small businesses, a combination of using QuickBooks and seeking occasional assistance from a bookkeeper may strike the right balance between efficiency and financial accuracy.