You can track your bills and expenses using a spreadsheet or a budgeting app. Many people use apps like Mint, Quicken, or YNAB. Tracking bills and expenses is crucial for managing your finances effectively and ensuring that you meet your financial obligations. Here are steps to help you track your bills and expenses:

- Create a Budget:

- Start by creating a budget that outlines your income and planned expenses. Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment) categories.

- List All Your Bills:

- Make a comprehensive list of all your recurring bills, including rent or mortgage, utilities, insurance, subscriptions, loan payments, and any other regular expenses.

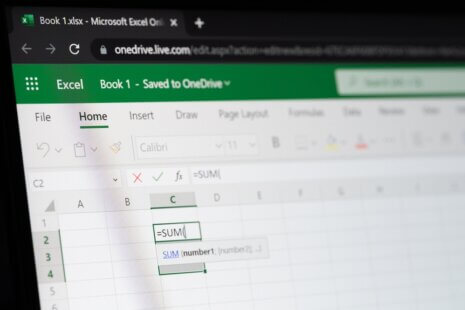

- Set Up a System:

- Choose a system for tracking your bills and expenses. This could be a physical planner, a spreadsheet, financial management software, or a dedicated budgeting app. Popular apps include Mint, YNAB (You Need A Budget), and PocketGuard.

- Calendar Reminders:

- Set up calendar reminders for due dates of recurring bills. This ensures that you are aware of upcoming payments and can plan accordingly.

- Automate Payments:

- Whenever possible, set up automatic payments for recurring bills. This helps prevent late fees and ensures that your bills are paid on time.

- Use Envelopes or Categories:

- If you prefer a tangible method, use envelopes or create categories for different types of expenses. Allocate a certain amount of cash or budget to each category, and only spend what’s allocated.

- Keep Receipts:

- Save receipts for all your purchases. This is especially important for tracking variable expenses and provides a record for budgeting and tax purposes.

- Review Statements Regularly:

- Regularly review your bank and credit card statements to ensure that all transactions are accurate. This helps catch any unauthorized or erroneous charges.

- Track Variable Expenses:

- For variable expenses like groceries, dining out, or entertainment, keep a log or use an app to track your spending. This can help you identify areas where you can cut back if needed.

- Emergency Fund:

- Consider setting up an emergency fund to cover unexpected expenses. This can prevent you from having to dip into other areas of your budget.

- Prioritize Payments:

- Prioritize your bills based on due dates and importance. This ensures that critical bills are paid first.

- Monitor Due Dates:

- Be mindful of due dates for bills. Late payments can result in fees and may negatively impact your credit score.

- Adjust Your Budget:

- Regularly review and adjust your budget as needed. Life circumstances and financial goals may change, and your budget should reflect these changes.

- Use Budgeting Apps:

- Take advantage of budgeting apps that can automatically sync with your bank accounts and credit cards, categorize expenses, and provide insights into your spending habits.

- Check for Subscriptions:

- Periodically review and cancel any subscriptions or services that you no longer need. Unused subscriptions can accumulate and contribute to unnecessary expenses.

- Plan for Irregular Expenses:

- Anticipate irregular expenses such as annual insurance premiums or holiday spending. Budget for these expenses throughout the year.

- Review Monthly Reports:

- If you use financial management software or apps, review monthly reports to analyze your spending patterns. This can help you identify areas where you can save or make adjustments.

- Seek Professional Advice:

- If managing your bills and expenses becomes overwhelming, consider seeking advice from a financial advisor. They can provide guidance on budgeting, debt management, and financial planning.

Consistent and proactive tracking of your bills and expenses is key to maintaining financial stability and achieving your financial goals. Choose a method that works best for you and make it a regular part of your routine to ensure financial health.