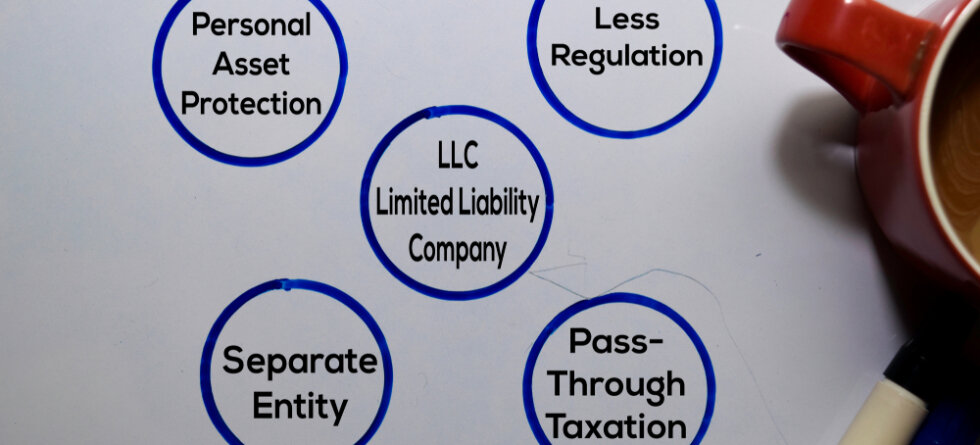

A Limited Liability Company (LLC) is a popular business structure that offers certain advantages, including potential tax benefits. While an LLC is not a tax entity itself, it provides flexibility in how it’s taxed, and this flexibility can be used to potentially reduce personal taxes for the LLC members.

Here are some ways an LLC may reduce personal taxes:

- Pass-Through Taxation: Most LLCs are taxed as pass-through entities. This means that the business’s income and expenses “pass through” to the individual members’ personal tax returns. As a result, the business itself does not pay income taxes at the corporate level, which can help avoid double taxation.

- Self-Employment Tax Savings: Members of an LLC who are actively involved in the business may be able to classify a portion of their income as a distribution rather than a salary. Distributions are not subject to self-employment tax (Social Security and Medicare taxes), potentially resulting in tax savings. It’s important to determine a reasonable salary for active members to avoid IRS scrutiny.

- Business Deductions: LLC members may be eligible for various business deductions that can reduce their taxable income. These deductions can include expenses related to running the business, such as rent, utilities, office supplies, and marketing expenses.

- Loss Offsetting: If the LLC generates a net operating loss (NOL), this loss can often be used to offset other income on the member’s personal tax return. This can potentially reduce the member’s overall tax liability.

- Qualified Business Income Deduction (QBI): Under certain circumstances and subject to limitations, business owners, including LLC members, may be eligible for the QBI deduction. This deduction can reduce the effective tax rate on qualified business income.

- Deductions for Health Insurance Premiums: If the LLC offers health insurance to its members, these premiums may be tax-deductible for the business and may also provide tax benefits for the individuals.

- Retirement Plan Contributions: LLC members can establish and contribute to retirement plans, such as SEP-IRAs or Solo 401(k)s, which can lower taxable income and provide retirement savings.

- Income Splitting: If the LLC has multiple members, income can be distributed among them in a way that optimizes their individual tax situations. This may include distributing more income to members in lower tax brackets.

The specific tax benefits and strategies available to LLC members can vary based on factors like the LLC’s structure (single-member or multi-member), the members’ roles and activities within the business, the business’s industry, and changes in tax laws.

For personalized tax advice and to maximize the potential tax benefits of your LLC, it’s advisable to consult with a qualified tax professional, such as a certified public accountant (CPA) or tax attorney, who can assess your individual circumstances and provide guidance on tax optimization strategies.