Basic bookkeeping in Excel can be a cost-effective and straightforward way for small businesses and individuals to manage their financial records. Here’s a step-by-step guide on how to perform basic bookkeeping using Microsoft Excel:

1. Set Up Your Excel Workbook:

- Open Excel and create a new workbook. You can use a blank spreadsheet or find pre-designed templates for financial record-keeping. You may want to create separate worksheets for different financial aspects like income, expenses, and financial statements.

2. Create Categories:

- In your Excel workbook, set up categories for your income and expenses. Common categories include “Income,” “Rent,” “Utilities,” “Office Supplies,” “Advertising,” and “Taxes.”

3. Record Income:

- In the “Income” worksheet or section, enter the details of your income sources. This may include sales, client payments, and any other sources of revenue. Include the date, source, description, and the amount received.

4. Record Expenses:

- In the “Expenses” worksheet or section, record all your expenses. List the date, payee/vendor, expense category, description, and the amount spent. Be sure to include all business-related expenses, such as rent, utilities, supplies, and any other costs.

5. Perform Regular Entries:

- Consistency is crucial. Regularly enter income and expenses into your Excel spreadsheet as they occur. This ensures accurate and up-to-date financial records.

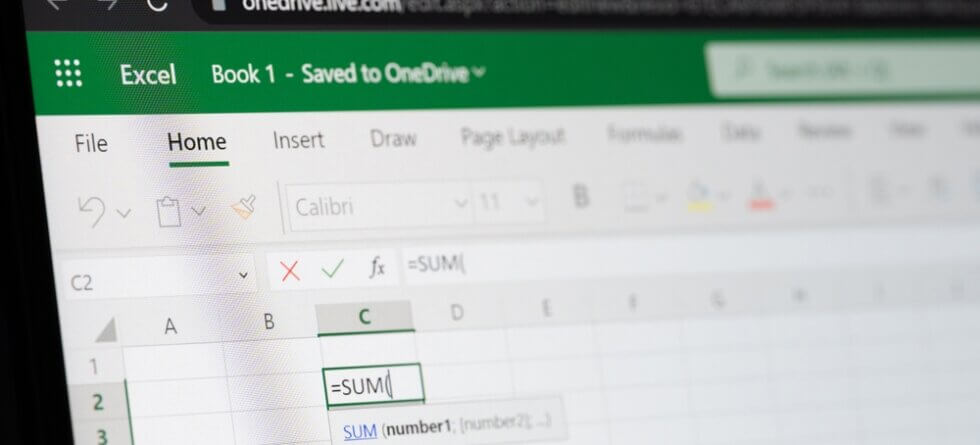

6. Use Formulas for Calculations:

- Excel can perform calculations for you. Use formulas to calculate totals for income and expenses. For example, you can use the SUM function to calculate the total income or expenses for a specific period.

7. Reconciliation:

- Regularly reconcile your records with bank statements and other financial documents to identify discrepancies or errors. This helps ensure your Excel bookkeeping aligns with your actual financial transactions.

8. Create Financial Reports:

- Excel allows you to create financial reports such as profit and loss statements, balance sheets, and cash flow statements. You can use these reports to assess your financial health and make informed decisions.

9. Formatting and Organization:

- Keep your Excel workbook well-organized and properly formatted. Use clear headers, date columns, and category divisions to ensure readability and ease of use.

10. Backup Your Data:

- Regularly back up your Excel workbook to prevent data loss. Consider saving a copy to an external drive or a cloud storage service.

11. Regularly Review and Analyze:

- Periodically review your financial records to gain insights into your business’s financial performance. This can help you make informed financial decisions.

While basic bookkeeping in Excel can be effective for many small businesses, it’s important to keep in mind that as your business grows, you may benefit from using dedicated accounting software that offers more advanced features and reporting capabilities. Such software can also streamline tax preparation and compliance. If your business becomes more complex, you may consider consulting with a professional bookkeeper or accountant for guidance on maintaining your financial records accurately.