Mixing business and personal money is commonly referred to as “commingling funds.” Commingling funds occurs when there’s no clear separation between personal finances and business finances. This can happen in various ways, such as using personal funds to cover business expenses or using business funds for personal expenses.

Commingling funds can lead to several problems…

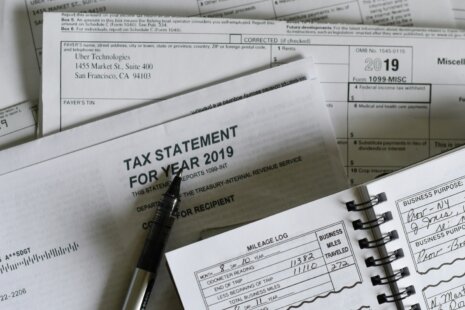

1. Legal and Tax Issues – Commingling funds can blur the line between personal and business liabilities, potentially exposing personal assets to business debts or legal actions. It can also complicate tax reporting and make it difficult to distinguish between personal and business expenses for tax purposes.

2. Loss of Limited Liability Protection – Maintaining a clear separation between personal and business finances is crucial for preserving the limited liability protection that business entities such as LLCs and corporations offer. Commingling funds may weaken this protection and increase the risk of personal liability for business debts or legal obligations.

3. Accounting and Financial Mismanagement – Commingling funds can make it challenging to track business expenses accurately, leading to accounting errors, financial mismanagement, and difficulty in preparing financial statements or reports.

To avoid commingling funds, business owners should establish separate bank accounts for their business and personal finances. They should also use separate accounting systems to track income and expenses for each entity. By maintaining a clear separation between personal and business finances, business owners can ensure compliance with legal and tax requirements, protect their limited liability status, and effectively manage their finances.